Enterprise Solutions

Overview

Solutions and services that help address labor shortages and improve operational efficiency

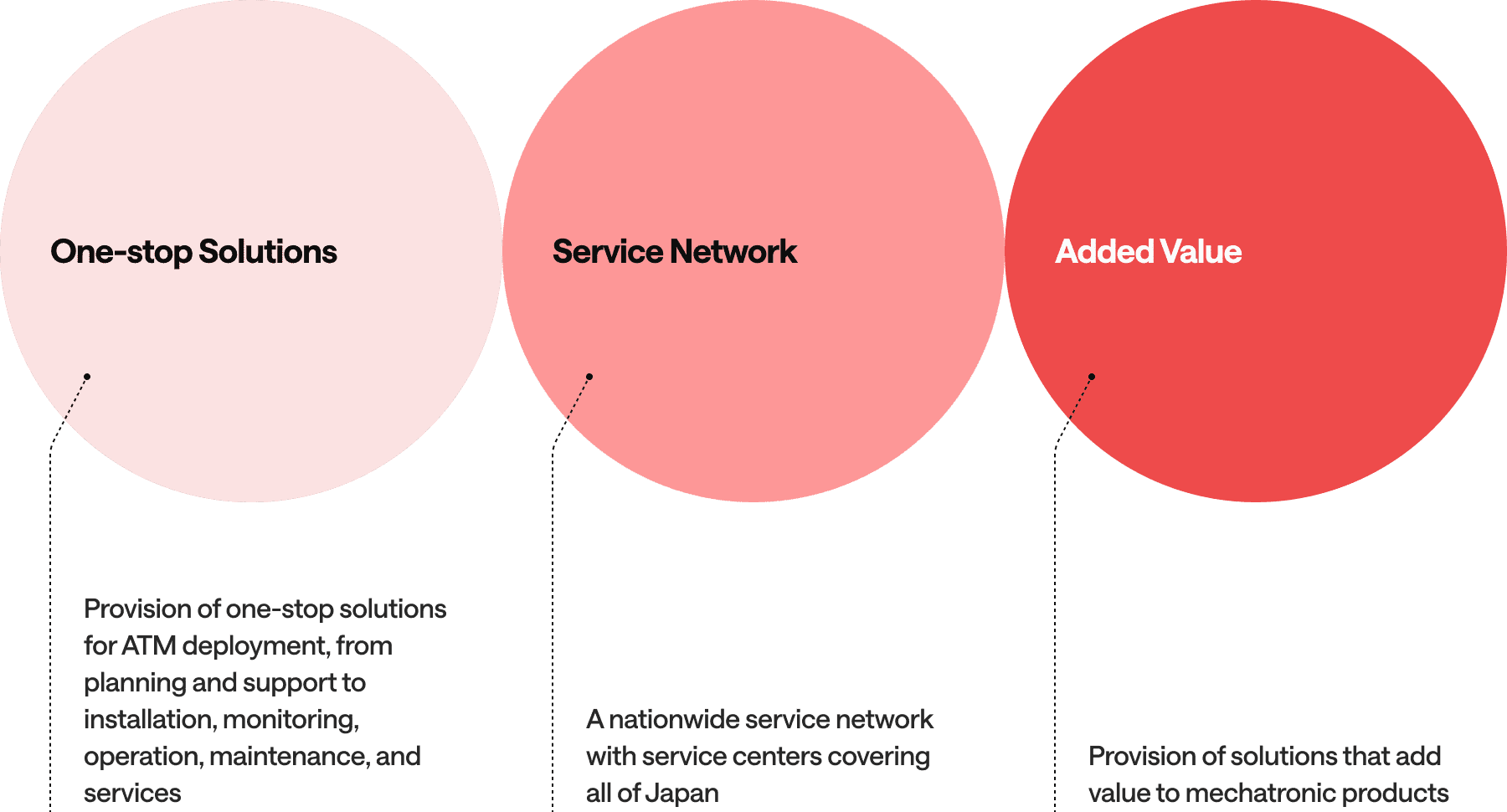

Our Advantage

Main Products and Solutions

-

Financial Institution

Sales branch and centered-administration systems(ATMs, SmartCashStation, bank branch systems, cash handling equipment)

-

Retail

Cash handling systems (cash dispensers, coin conversion machines, etc.)

-

Passenger Transportation

Self-service baggage check-in machines, self-tagging machines, self-check-in terminals, ticket reservations and issuing terminals, railway ticketing systems, etc.

-

Manufacturing

Projection assembly system, behavioral analysis, etc.

Vision for 2031

| Expansion of recurring business |

In shifting to recurring business, we are offering solutions for labor shortages by expanding services for financial institutions and store operations. We will also leverage assets to expand into non-financial markets. |

|---|---|

| Launch of products focused on front-office processing |

For the shift to front-office processing, we will introduce products that promote automation and labor-saving (self-service solutions) in the retail, manufacturing, aviation, and railway markets. In fiscal year 2024, we plan to launch eight new models domestically and internationally: two domestic ATM models, two coin dispensers, two cash handling machines, one ticketing terminal, and one international ATM model. We will also expand the recurring business by combining products and services. |

| Ongoing investment to strengthen product competitiveness |

In terms of strengthening product competitiveness, we will utilize AI technology in ATM services to enhance operations and improve productivity. We will drive efficiency in monitoring and maintenance, promoting the automation of advanced support to boost competitiveness. By standardizing product modules and restructuring the overseas production system, we will work to shorten development cycles, release products quickly, reduce production costs, strengthen price competitiveness, and lower maintenance costs. |

Safe and Convenient Social Infrastructure / Job Satisfaction and Productivity Enhancement

A self-service deposit and withdrawal machine for financial institutions has been introduced to regional banks and is now fully operational. This product integrates with the bank’s core system, allowing for easy deposits and withdrawals using a QR code® generated by a tablet where transaction information is pre-entered. By enabling customers to handle their own cash transactions, the machine reduces the workload at bank counters, minimizes errors, and facilitates quicker transactions. Beyond handling cash transactions, this solution improves customer satisfaction and enhances the efficiency of bank operations. The labor hours saved as a result can be redirected toward more customer-focused tasks, thereby contributing to improved job satisfaction.