At A Glance

Profile

| Company Name |

Oki Electric Industry Co., Ltd. |

|---|---|

| Founded |

1881 |

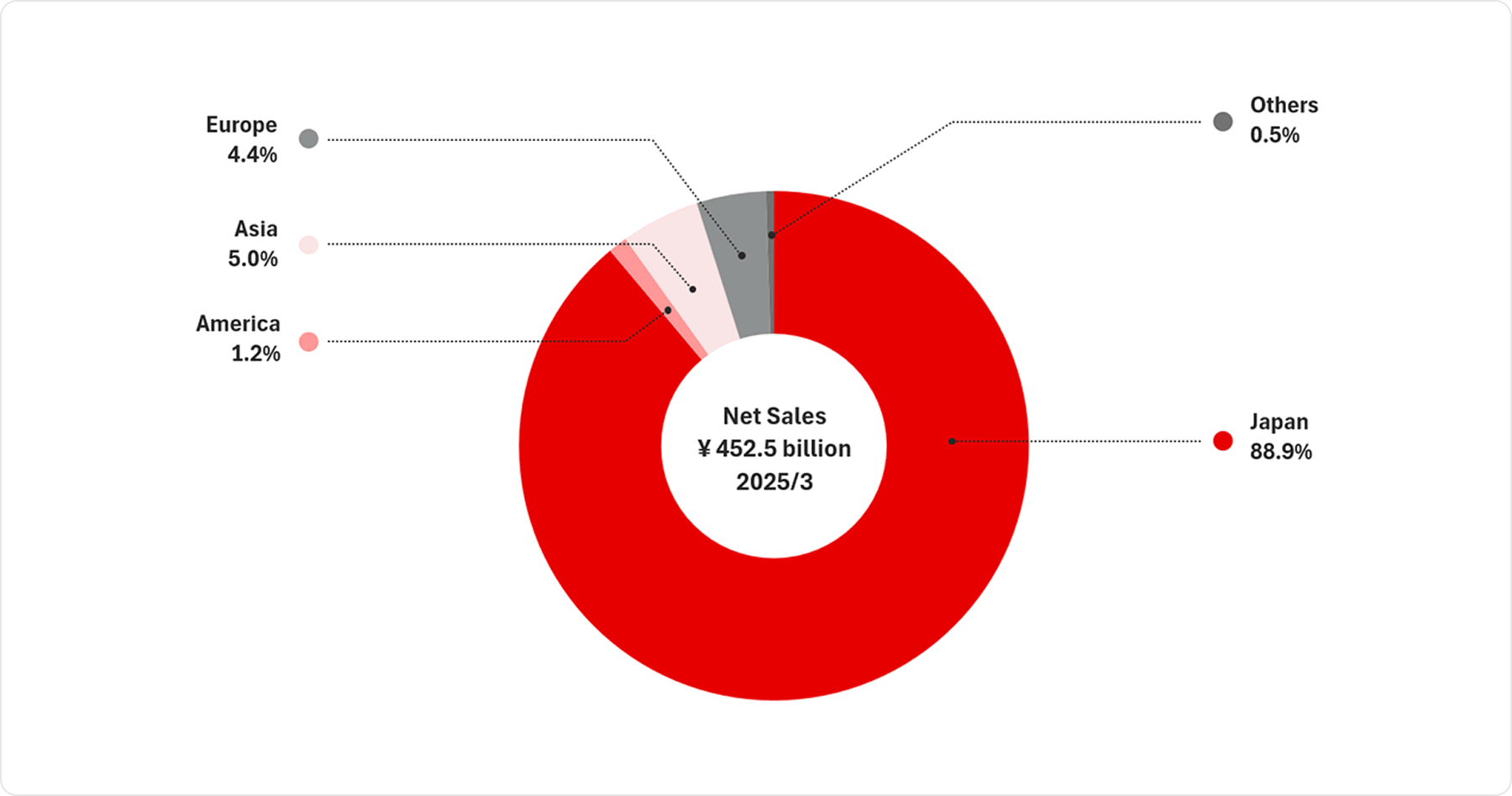

| Net Sales |

¥452.5 billion (consolidated fiscal year end. Mar. 31, 2025) |

| Capital |

¥44.0 billion |

| CEO |

Takahiro Mori |

| Employees |

13,906 (consolidated, as of Mar. 31, 2025) |

| Head Office |

1-7-12 Toranomon, Minato-ku, Tokyo, 105-8460, Japan |

| Tel |

+81-3-3501-3111 |

| Stock Exchange Listing |

The Prime Market of the Tokyo Stock Exchange |

| Securities Code |

6703 |

| Share Unit |

100 shares |

| Fiscal Year-end |

March 31 |

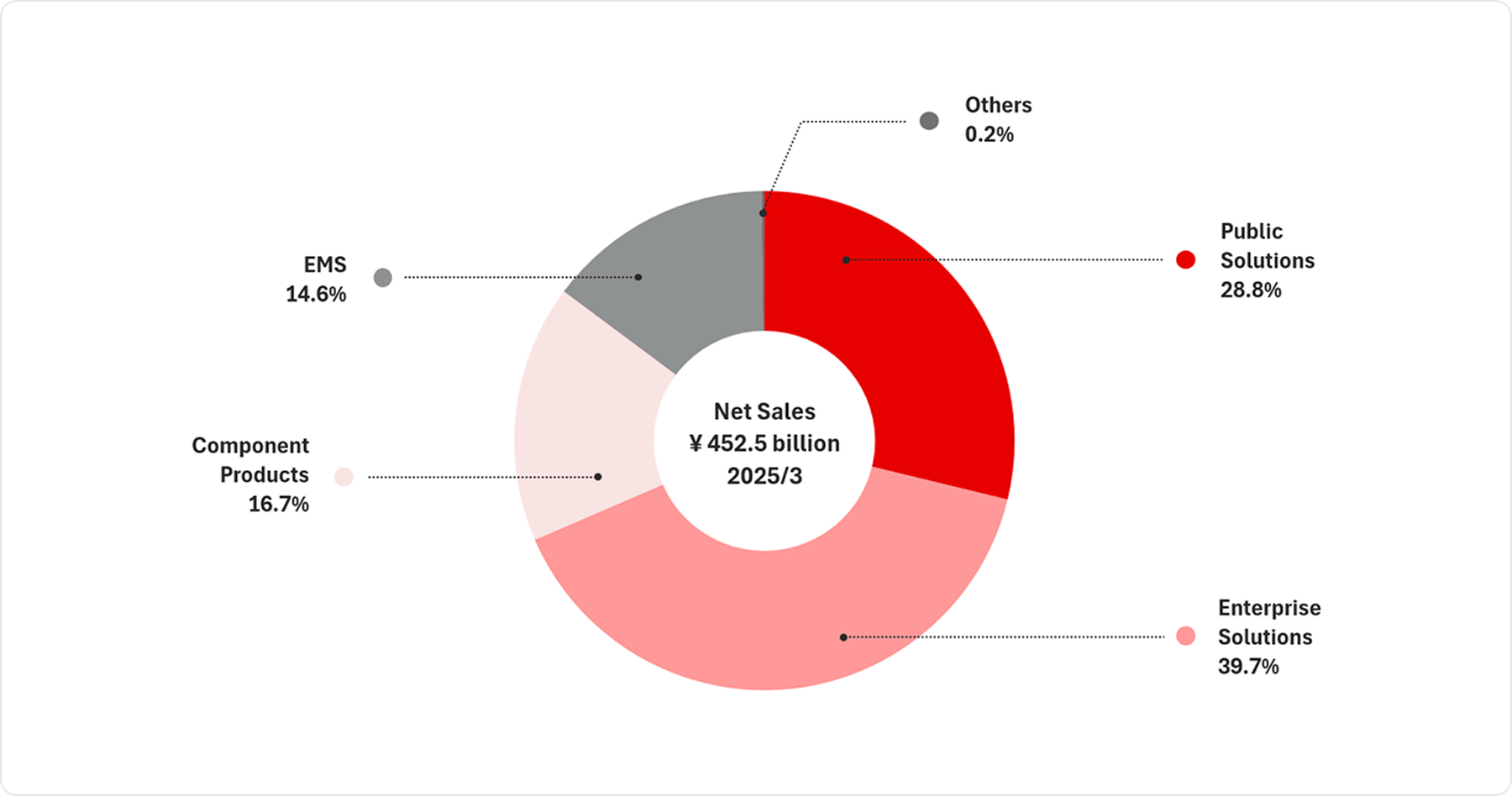

Net Sales by Segment

OKI Group businesses consist of four segments including Public Solution, Enterprise Solutions, Component Products and EMS.

Main Businesses

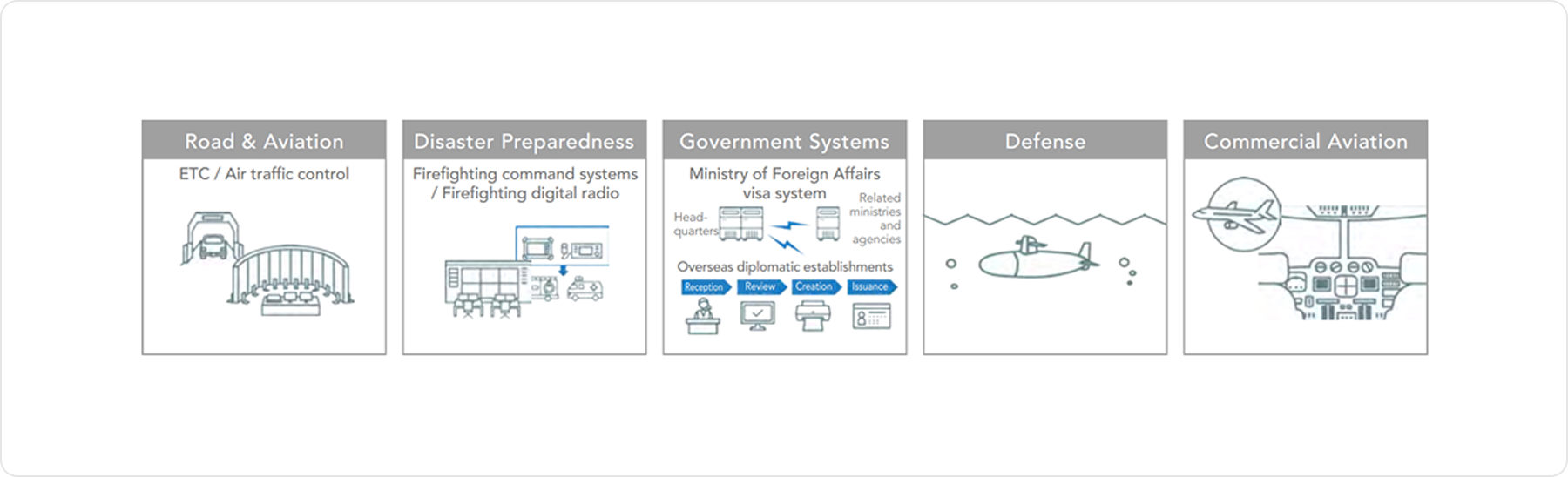

Public Solutions

Mission-critical solutions underpinning social infrastructure

Business Overview

We provide mission-critical solutions that support society to government agencies, municipalities, and infrastructure companies.

These include air traffic control systems, ETC, traffic probe data, firefighting command and radio systems, municipal disaster preparation radio systems, and other disaster preparation solutions. Additionally, we offer business solutions for central government agencies, defense-related systems, networks ranging from edge to backbone, and commercial aircraft displays.

Business Policy

Our business policy is to continually provide valuable solutions that meet the expectations of customers involved in "social infrastructure" and to grow and develop together with them. In the firefighting sector, where major system upgrades are planned, we aim to ensure stable profits by launching new products to expand our market share. Additionally, in the transportation sector, we are laying the groundwork for future growth with initiatives related to automated driving and V2X.

In the steadily growing defense business, we will increase production and strengthen our proposal capabilities to keep pace with the expanding domestic market. For production expansion, we plan to upgrade our barge for measurements in the ocean to enhance the efficiency of ocean measurements and invest in production line equipment. In the growing ocean market, we aim to expand our market presence by applying OKI's core technologies to our expertise in "sound" and to secure new markets. At the same time, we are beginning to participate in national ocean-related projects. To further our global expansion efforts, we have established a base in Singapore, targeting the expansion of overseas sales channels.

| Understanding the Business Environment | |

|---|---|

| Opportunities |

|

| Threats |

|

| Business Strengths and Possible Issues/Challenges | |

|---|---|

| Strengths |

|

| How to address possible issues/challenges |

|

Enterprise Solutions

Solutions and services that help address labor shortages and improve operational efficiency

Business Overview

In addition to the design, development, and manufacturing of mechatronic products, we offer advanced solutions that include network integration. Furthermore, we have established a comprehensive value chain, from installation, construction, and maintenance to full outsourcing services for ATM operation and monitoring. This allows us to provide solutions that enhance the value of mechatronic products and offer more efficient, reliable monitoring, operation, and maintenance, delivering safe and convenient services to our customers.

Following the strong performance in fiscal year 2023, we also expect to see steady sales and operating income due to large, one-off projects in fiscal year 2024. Although it is anticipated to benefit from already secured projects and the rollout of new products in fiscal year 2025 too, we will transform our business structure in light of future shifts toward cashless and paperless environments.

Business Policy

Taking advantage of large projects, we aim to transition to a leaner, more resilient management structure for future growth and transform our business model from product-focused to service-centered, ensuring business stability. To achieve this transformation, we are advancing three key initiatives in tandem: "shift to recurring business," "shift to front-office processing," and "strengthen product competitiveness." These efforts aim to transition the business into a stable operation beyond fiscal year 2025. Based on OKI's strong product foundation, we will continue to develop and provide solutions and services that solve social issues.

| Understanding the Business Environment | |

|---|---|

| Opportunities |

|

| Threats |

|

| Business Strengths and Possible Issues/Challenges | |

|---|---|

| Strengths |

|

| How to address possible issues/challenges |

|

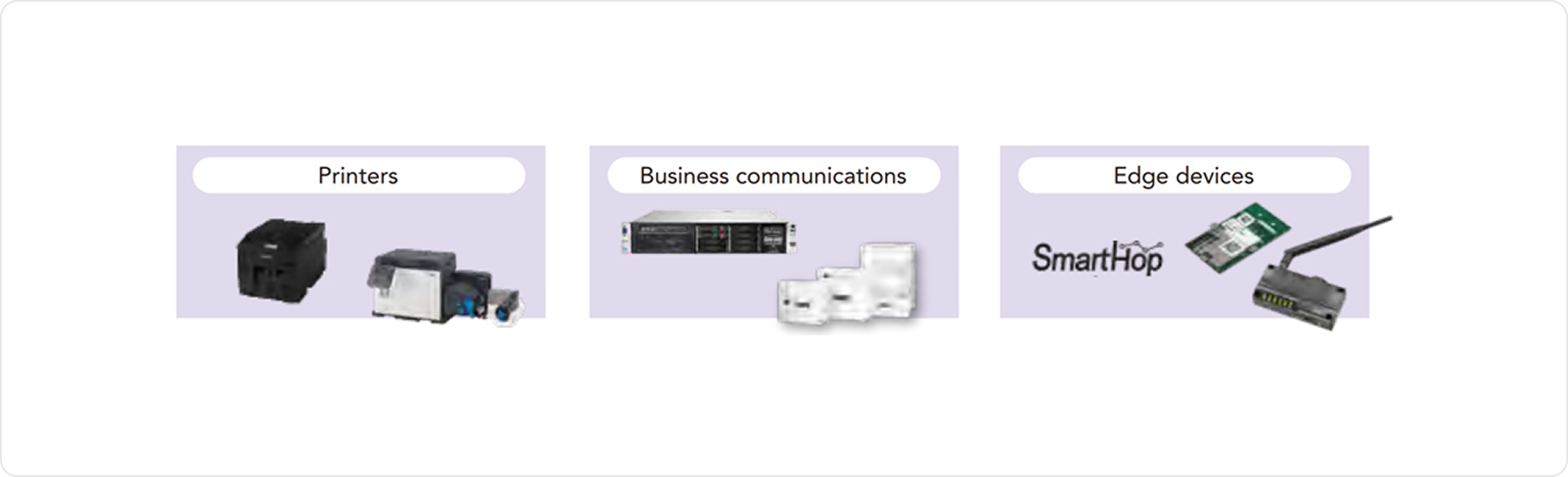

Component Products

Components for sensing, AI, communications and output that contribute to society

Business Overview

The printer and business communication markets are generally considered mature and are expected to see a slight decline in the future. However, in the printer market, efforts to reduce the burden of development costs across companies are progressing, leading to an increase in opportunities for OKI to leverage its strengths by offering OEM printer engines and engage in joint development. In the area of Edge devices, the global market for carbon neutrality and infrastructure monitoring is expected to expand. Given OKI's strengths in energy-saving, wireless technology, and environmental durability, we anticipate growth in sales moving forward.

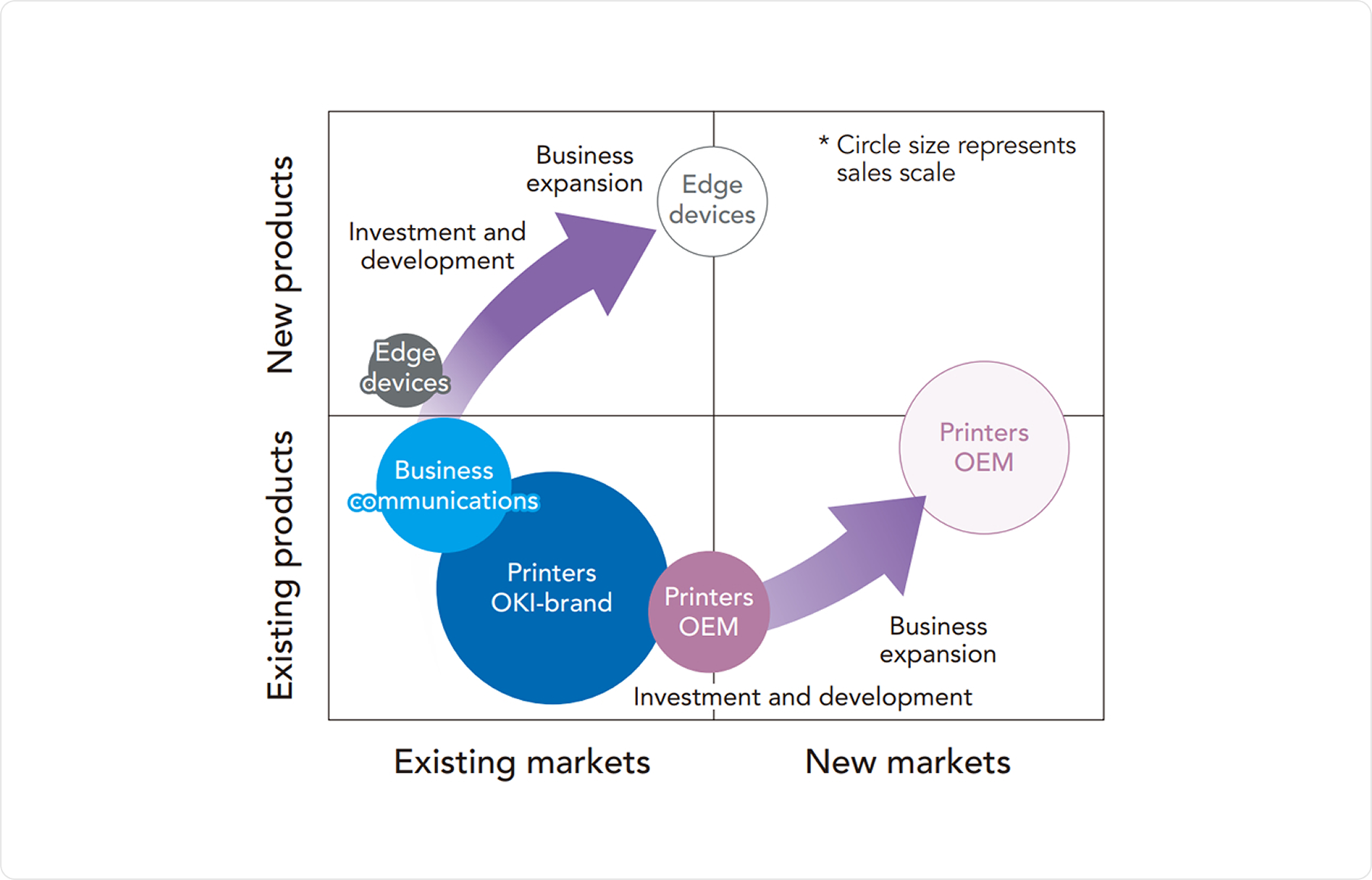

Business Policy

Under the Medium-Term Business Plan 2025, we aim to stabilize profits by promoting structural reforms in our two core business areas (as shown in the diagram on the right: OKI-branded printers and business communications). This includes reviewing product lineups, reallocating personnel, and optimizing development investments.

Additionally, we will make proactive investments in key focus areas, fostering growth in the Edge device and printer OEM businesses, with the goal of achieving 100 billion yen in sales and a 7% operating profit margin by fiscal year 2031.

| Understanding the Business Environment | |

|---|---|

| Opportunities |

|

| Threats |

|

| Business Strengths and Possible Issues/Challenges | |

|---|---|

| Strengths |

|

| How to address possible issues/challenges |

|

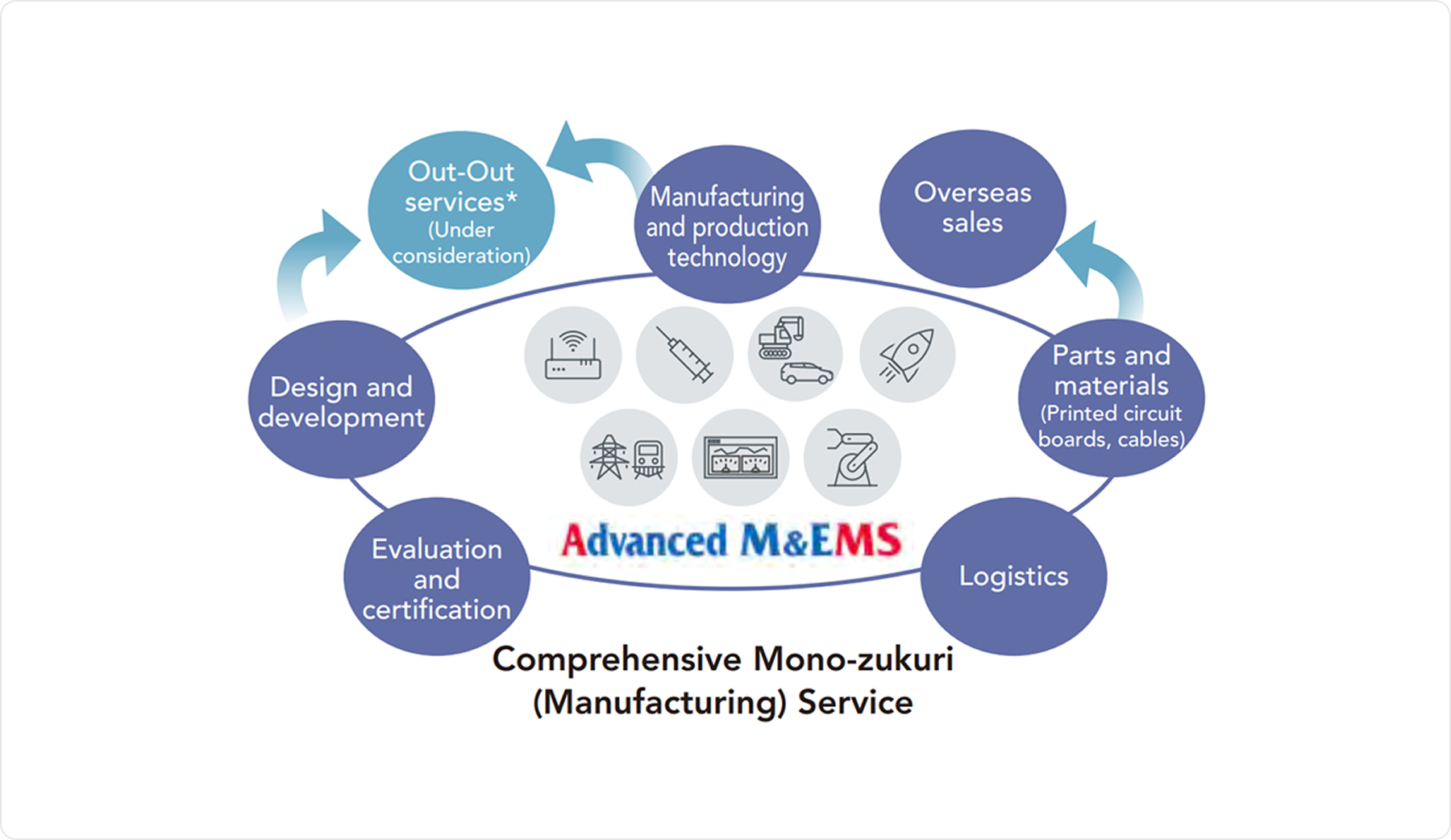

EMS

One-stop comprehensive manufacturing services from design to manufacturing and reliability testing

Business Overview

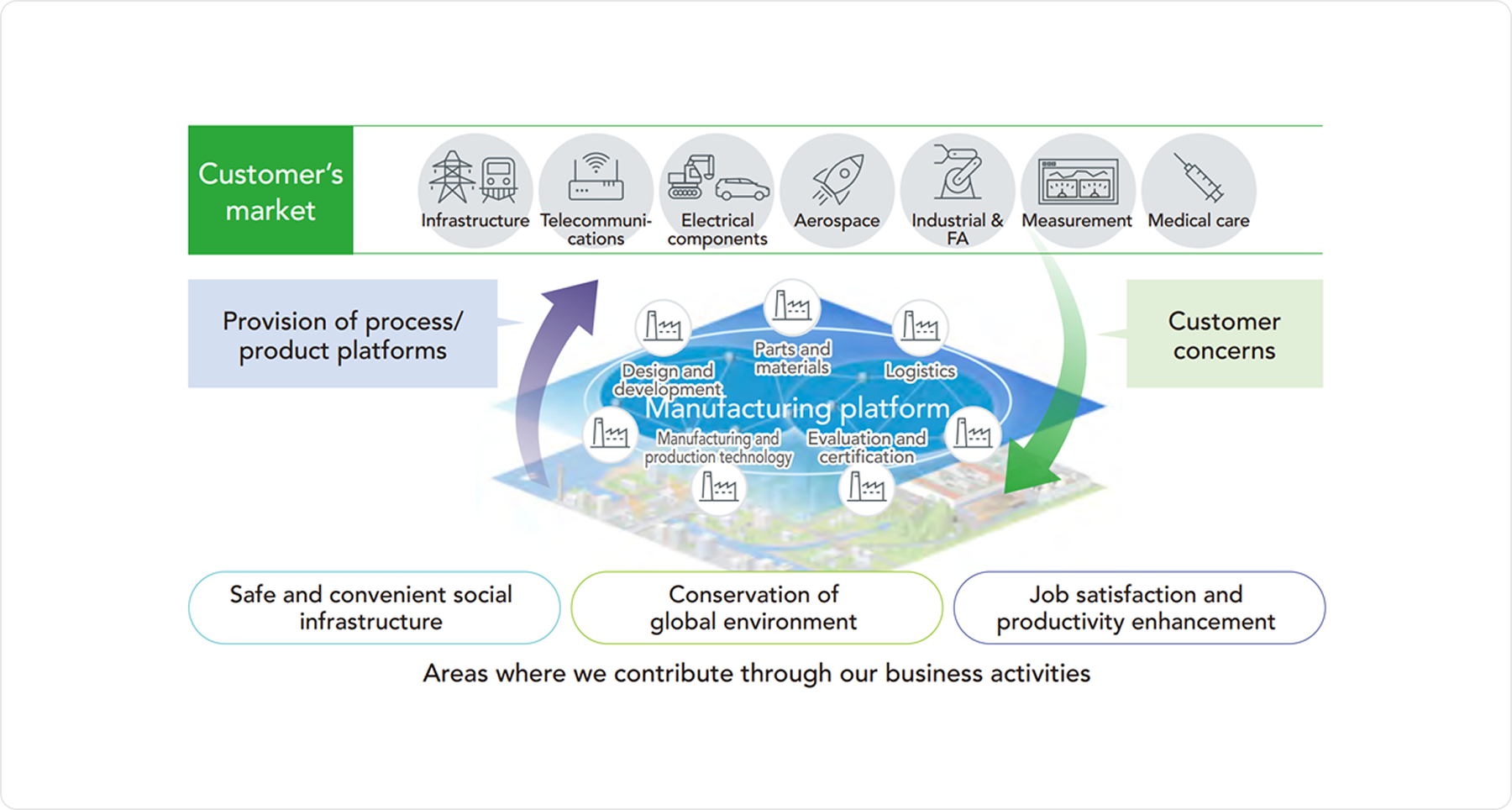

We provide one-stop solutions for Mono-zukuri (manufacturing) that accommodate variable-mix variable-volume, high quality, and high added value. Our business is primarily composed of "EMS/DMS business," "components business," and "engineering business." Through collaboration within the EMS Group, we provide a wide range of services covering every process from upstream to downstream manufacturing, leveraging the technology and expertise OKI has developed over many years of production.

Business Policy

We aim to become a manufacturing platform provider that supports customers in addressing their challenges from a production perspective. By offering design and manufacturing processes filled with accumulated know-how and standardized products as components or modules as platform-based products and services, we will contribute to solving our customers' social challenges through OKI's manufacturing expertise.

| Understanding the Business Environment | |

|---|---|

| Opportunities |

|

| Threats |

|

| Business Strengths and Possible Issues/Challenges | |

|---|---|

| Strengths |

|

| How to address possible issues/challenges |

|

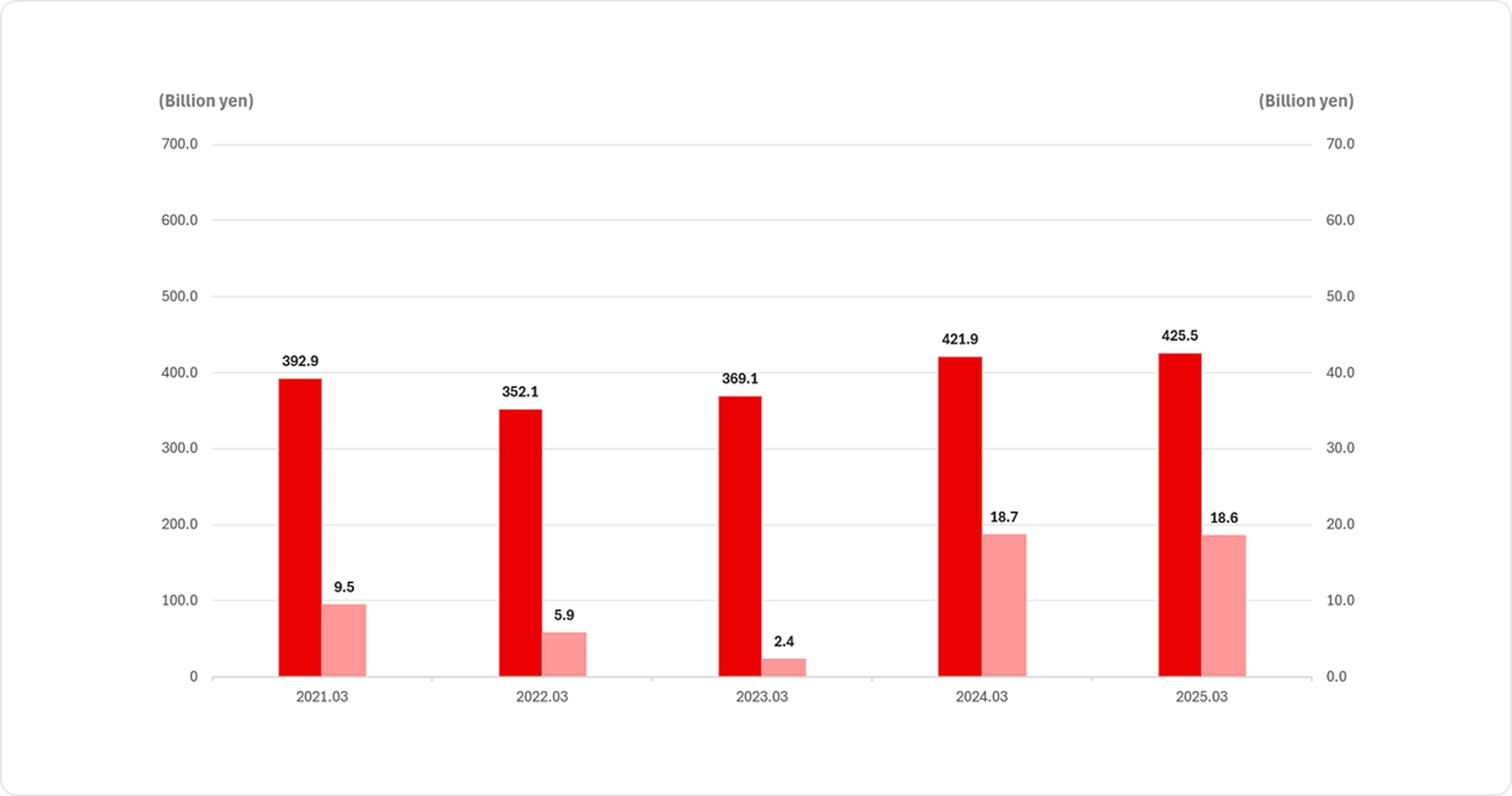

Financial Highlights

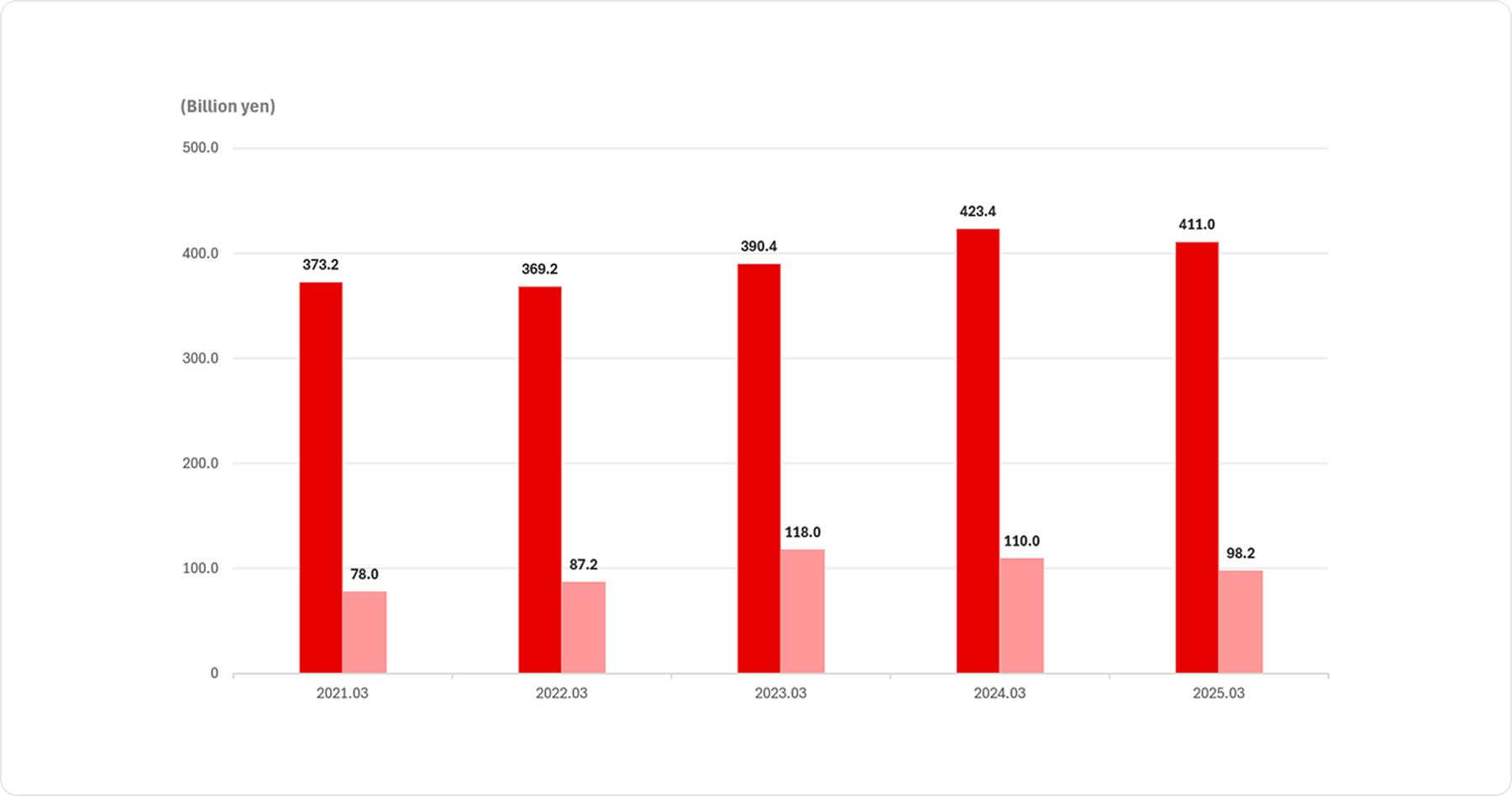

Net Sales and Operating Income

Net Sales by Region

Total Assets and Interest-bearing Debt

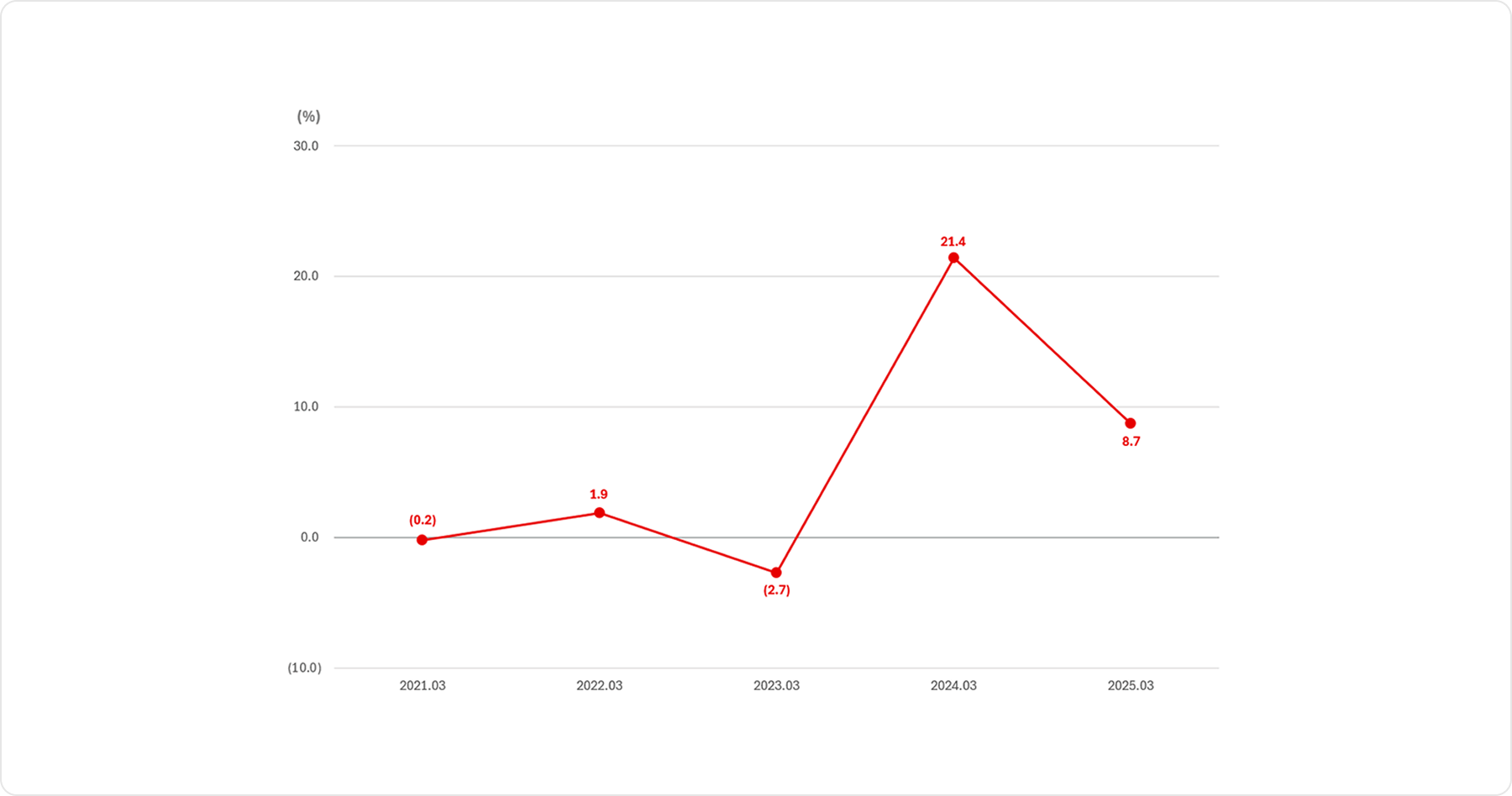

ROE

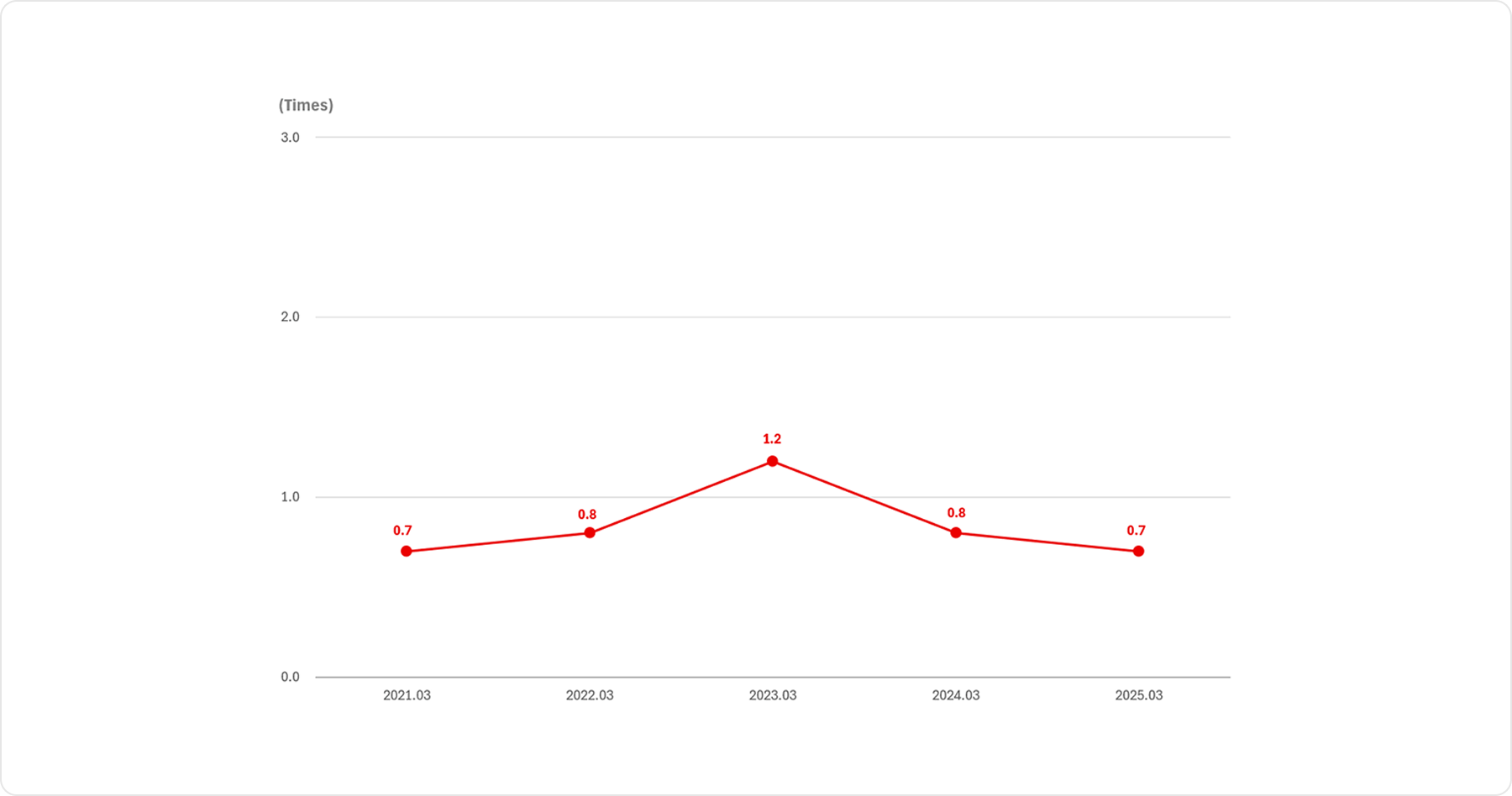

DE ratio