Corporate, Financials, HR

Notice Regarding Revisions to Consolidated Earnings Forecasts and Dividend Forecast for the Fiscal Year Ending March 31, 2023

TOKYO, February 9, 2023 -- Given the recent trends in its business performance and others, OKI has decided to revise the consolidated earnings forecast for the fiscal year ending March 31, 2023 announced on May 11, 2022, and the dividend forecast. Details are as follows:

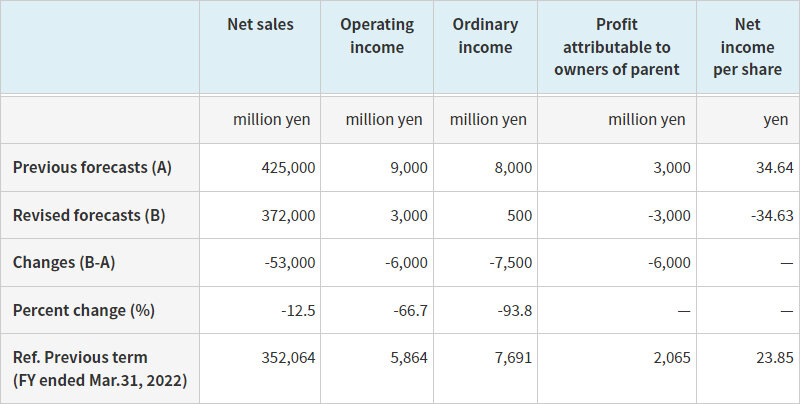

1. Revisions of consolidated earnings forecasts 1) Revised consolidated earning forecasts for the fiscal year ending March 31, 2023

2) Reasons for the revision

Net sales are expected to be lower than previously forecast, mainly because we now expect the negative impact of the production (caused by the difficulty in procuring components such as semiconductors) to be greater than anticipated at the beginning of the fiscal year.

In terms of profits, we now expect operating income, ordinary income, and net income attributable to owners of the parent to be lower than previously forecast, although the impact of production declines caused by supply chain disruptions, higher component prices, currency fluctuations and the negative impact of failed software development projects have been partially offset by the effects of appropriate selling prices and reduced fixed costs.

On the other hand, we are making steady progress in strengthening our ability to respond to supply chain impacts, which is a priority issue for us this fiscal year, and we will continue to make further efforts to minimize the impact.

2. Revisions of dividend forecasts

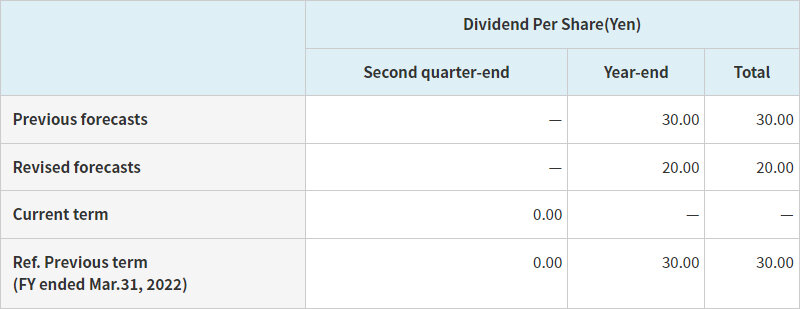

1) Revised dividend forecasts for the fiscal year ending March 31, 2023

2) Reasons for the revision

OKI recognizes that strengthening its financial structure and securing internal reserves for enhancing the OKI Group's corporate value, as well as striving to increase returns to shareholders who will hold shares over the medium to long term, are management's highest priorities. We determine dividend on the basis of stable and continuous shareholder returns, taking into comprehensive consideration business performance and future management measures.

Based on the earnings forecast, financial condition and etc., we plan to pay a dividend of 20 yen per share for the fiscal year ending March 31, 2023.

The projections and plans on this document are subject to change depending upon the changes of business environments and other conditions.

- Oki Electric Industry Co., Ltd. is referred to as "OKI" in this document.

Information in the press releases is current on the date of the press announcement, but is subject to change without prior notice.